UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

|

Filed by the Registrant x |

|

|

|

Filed by a Party other than the Registrant o |

|

|

|

Check the appropriate box: |

|

o |

Preliminary Proxy Statement |

|

o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

o |

Definitive Proxy Statement |

|

o |

Definitive Additional Materials |

|

x |

Soliciting Material under §240.14a-12 |

|

|

|

QUALCOMM INCORPORATED |

|

(Name of Registrant as Specified In Its Charter) |

|

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

|

|

Payment of Filing Fee (Check the appropriate box): |

|

x |

No fee required. |

|

o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

(1) |

Title of each class of securities to which transaction applies: |

|

|

|

|

|

|

(2) |

Aggregate number of securities to which transaction applies: |

|

|

|

|

|

|

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

|

|

|

|

(4) |

Proposed maximum aggregate value of transaction: |

|

|

|

|

|

|

(5) |

Total fee paid: |

|

|

|

|

|

o |

Fee paid previously with preliminary materials. |

|

o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

Amount Previously Paid: |

|

|

|

|

|

|

(2) |

Form, Schedule or Registration Statement No.: |

|

|

|

|

|

|

(3) |

Filing Party: |

|

|

|

|

|

|

(4) |

Date Filed: |

|

|

|

|

|

|

|

|

The following employee communication may be provided to stockholders of Qualcomm Incorporated (“Qualcomm”).

To: qualcomm.all

From: Michelle Sterling

Subj: Change in Control Severance Plan Filing

As Steve shared in his email, today we filed a Non-Executive Officer Change in Control (CIC) Severance Plan with the U.S. Securities and Exchange Commission (SEC). The plan provides financial protection to employees in the event that their employment is terminated under certain circumstances following a “Change in Control.” However, this plan does not cover employees at the level of EVP and above. I want to share some information to help you understand what this plan means, and why we implemented it at this time.

As you know, Broadcom recently made an unsolicited proposal to acquire Qualcomm, which our Board unanimously rejected. Broadcom has also nominated 11 individuals to replace our existing Board of Directors, and our Board determined that electing Broadcom’s nominees would not be in the best interests of Qualcomm or its stockholders, which includes the vast majority of our employees. Our Board remains committed to acting in the best interests of all Qualcomm stockholders and stands firm in its position that Broadcom’s offer dramatically undervalues the company.

Nonetheless, given these activities, we recognize that employees may have concerns about how their employment could be impacted if control of the company were to change. A CIC Severance Plan is an action many companies take to help with retention of employees as it provides financial support if their position were eliminated within a certain period of time after a Change in Control. It also helps mitigate concerns that job candidates might have about joining Qualcomm during this period of uncertainty.

The SEC filing may generate media coverage and fuel speculation about future plans. I want to strongly affirm that our adoption of the CIC Severance Plan is not intended to signal any new developments with regard to Broadcom’s proposal or Board nominations. It is an action taken by Qualcomm’s Board of Directors to support and retain our employees.

We are confident we have the right strategy, roadmap and employee talent to drive our future success, and we want to help all employees remain focused on the growing set of opportunities ahead so that we can continue to create value for the company and our stockholders. We hope this proactive measure will help alleviate uncertainty and provide security.

FAQs about this filing are provided below, and I encourage you to read through them for an overview of the plan.

Michelle Sterling

EVP, Human Resources

What is a Change in Control?

Under the plan, a “Change in Control” would generally occur if either (1) there were a transaction following which our pre-Change in Control stockholders ceased to own a majority of the resulting company’s stock or (2) there were a replacement of the majority of our current Board of Directors unless the new directors were approved by our current Board of Directors. In addition, our stock plan was amended so that the same definition applies in both plans.

Why did Qualcomm establish this Change in Control Severance Plan?

Qualcomm has maintained a practice of providing a supportive severance package to those whose jobs are eliminated in any layoff or restructuring. These practices, however, are not guaranteed by U.S. law or contract, and there is the possibility that an acquiring entity may provide support that is less than what Qualcomm would otherwise provide. Thus, employees may consider leaving the company because of the uncertainty in their financial position if their job was eliminated. This plan is designed to encourage employees to stay, knowing they have adequate protection in the event of a job elimination after a Change in Control. In addition, the news of a possible acquisition, even if unlikely, may affect the ability of Qualcomm to recruit new talent; therefore, having a documented severance plan helps mitigate some of these concerns.

Did we already have a Severance Plan?

While we already have robust severance practices, until now they had not been formalized in a plan such as this. By documenting this plan, and by including a condition that the benefits provided in the plan may not be reduced for at least two years after a Change in Control, we are providing more security to our employees in the event that a Change in Control takes place. We also made enhancements (i.e., minimum cash severance amounts) to ensure employees with less tenure would receive supportive assistance.

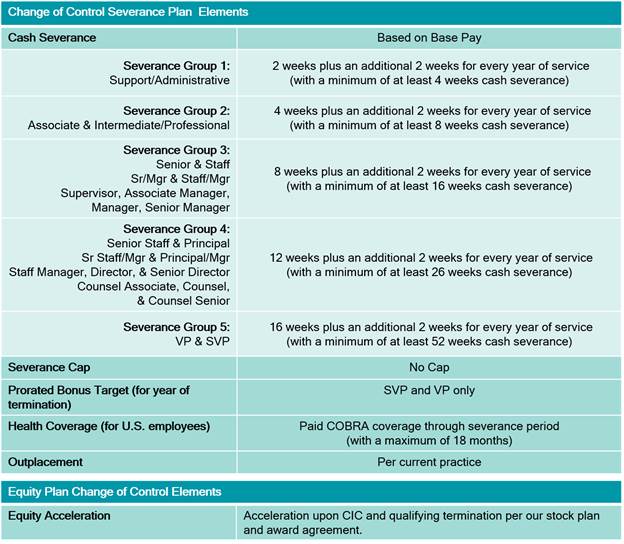

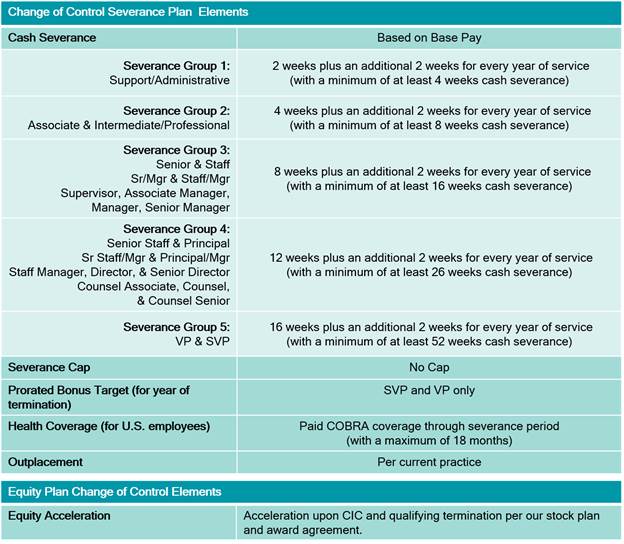

What are the components of the Change in Control Severance plan?

Under the plan, if a Change in Control were to take place and an employee were to incur a severance-qualifying termination, the employee would receive a cash severance package based on his or her job level and years of service. We have also established cash severance minimum amounts to ensure employees with less tenure would receive supportive assistance. As mentioned above, the same definition of Change in Control is in our stock plan, which means that any unvested stock awards would vest upon a qualifying termination. Employees would also receive outplacement support and U.S.-based employees would receive paid health care coverage through COBRA for the length of the severance period, but capped at 18 months.

Where can I get more information?

You can view a plan summary and additional FAQs here.

Additional Information

Qualcomm has filed a preliminary proxy statement and WHITE proxy card with the U.S. Securities and Exchange Commission (the “SEC”) in connection with its solicitation of proxies for its 2018 Annual Meeting of Stockholders (the “2018 Annual Meeting”). QUALCOMM STOCKHOLDERS ARE STRONGLY ENCOURAGED TO READ THE DEFINITIVE PROXY STATEMENT (AND ANY AMENDMENTS AND SUPPLEMENTS THERETO) AND ACCOMPANYING WHITE PROXY CARD WHEN THEY BECOME AVAILABLE AS THEY WILL CONTAIN IMPORTANT INFORMATION. Stockholders may obtain the proxy statement, any amendments or supplements to the proxy statement and other documents as and when filed by Qualcomm with the SEC without charge from the SEC’s website at www.sec.gov.

Certain Information Regarding Participants

Qualcomm, its directors and certain of its executive officers may be deemed to be participants in connection with the solicitation of proxies from Qualcomm’s stockholders in connection with the matters to be considered at the 2018 Annual Meeting. Information regarding the identity of potential participants, and their direct or indirect interests, by security holdings or otherwise, is set forth in the proxy statement and other materials to be filed with the SEC. These documents can be obtained free of charge from the sources indicated above.

Cautionary Note Regarding Forward-Looking Statements

Any statements contained in this communication that are not historical facts are forward-looking statements as defined in the U.S. Private Securities Litigation Reform Act of 1995. Words such as “anticipate,” “believe,” “estimate,” “expect,” “forecast,” “intend,” “may,” “plan,” “project,” “predict,” “should,” “will” and similar expressions are intended to identify such forward-looking statements. These statements are based on Qualcomm’s current expectations or beliefs, and are subject to uncertainty and changes in circumstances. Actual results may differ materially from those expressed or implied by the statements herein due to changes in economic, business, competitive, technological, strategic and/or regulatory factors, and other factors affecting the operations of Qualcomm. More detailed information about these factors may be found in Qualcomm’s filings with the SEC, including those discussed in Qualcomm’s most recent Annual Report on Form 10-K and in any subsequent periodic reports on Form 10-Q and Form 8-K, each of which is on file with the SEC and available at the SEC’s website at www.sec.gov. SEC filings for Qualcomm are also available in the Investor Relations section of Qualcomm’s website at www.qualcomm.com. Qualcomm is not obligated to update these forward-looking statements to reflect events or circumstances after the date of this communication. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of their dates.

Qualcomm Change in Control Severance Plan

Qualcomm has filed a Non-Executive Officer Change in Control (CIC) Severance Plan with the U.S. Securities and Exchange Commission (SEC), which provides financial protection to employees in the event that their employment is terminated under certain circumstances following a “Change in Control.” This plan does not cover employees at the level of EVP and above.

The following chart provides an overview of the of the CIC Severance Plan elements. The cash severance is determined by an employee’s job level. If you don’t see your job level listed on the chart, you can look up your Job Code in MySource (My Info —> Compensation —> Salary/Job Summary) and then view the job code list to see which severance group it aligns with.

Employees of the RF360 Joint Venture are included as part of this overall plan. Further information will be provided at a later date.

Frequently Asked Questions

What is a Change in Control?

Under the plan, a “Change in Control” would generally occur if either (1) there were a transaction following which our pre-Change in Control stockholders ceased to own a majority of the resulting company’s stock or (2) there were

a replacement of the majority of our current Board of Directors unless the new directors were approved by our current Board of Directors. In addition, our stock plan was amended so that the same definition applies in both plans.

Why did Qualcomm establish this Change in Control Severance Plan?

Qualcomm has maintained a practice of providing a supportive severance package to those whose jobs are eliminated in any layoff or restructuring. These practices, however, are not guaranteed by U.S. law or contract, and there is the possibility that an acquiring entity may provide support that is less than what Qualcomm would otherwise provide. Thus, employees may consider leaving the company because of the uncertainty in their financial position if their job was eliminated. This plan is designed to encourage employees to stay, knowing they have adequate protection in the event of a job elimination after a Change in Control. In addition, the news of a possible acquisition, even if unlikely, may affect the ability of Qualcomm to recruit new talent; therefore, having a documented severance plan helps mitigate some of these concerns.

Did we already have a Severance Plan? How is this different?

While we already have robust severance practices, until now they had not been formalized in a plan such as this. By documenting this plan, and by including a condition that the benefits provided in the plan may not be reduced for at least two years after a Change in Control, we are providing more security to our employees in the event that a Change in Control takes place. We also made enhancements (i.e., minimum cash severance amounts) to ensure employees with less tenure would receive supportive assistance.

What are the components of the Change in Control Severance plan?

Under the plan, if a Change in Control were to take place and an employee were to incur a severance-qualifying termination, the employee would receive a cash severance package based on his or her job level and years of service. We have also established cash severance minimum amounts to ensure employees with less tenure would receive supportive assistance. As mentioned above, the same definition of Change in Control is in our stock plan, which means that any unvested stock awards would vest upon a qualifying termination. Employees would also receive outplacement support and U.S.-based employees would receive paid health care coverage through COBRA for the length of the severance period, but capped at 18 months.

What is a qualifying termination?

A qualifying termination includes either an involuntary termination that is not for cause (e.g., losing your job as part of a layoff) or a voluntary termination for good reason (i.e., generally a material reduction in base salary, mandated relocation over a certain distance, or a failure of the acquirer to assume the plan) during the two-year period following a Change in Control.

If there are reductions without a Change in Control, is this Severance Plan applied?

No, this plan would only be applied if there is a Change in Control as defined by the plan, and it would apply to participating employees only if they were impacted by a qualifying termination. Your right to any severance benefits prior to a Change in Control would be determined in accordance with whatever severance practices the Company may have in effect from time to time. As is the case today, these practices are discretionary and may be modified or terminated at any time and may be different for different employees in different circumstances.

Who is eligible to participate in the CIC Severance Plan?

Substantially, all regular, full-time employees and part-time employees who work at least twenty hours per week are eligible for the plan. However, the plan does not cover employees at the level of Executive Vice President and above.

If I don’t see my job level listed on the chart, how do I determine which severance group my position is aligned with?

If you don’t see your job level listed on the chart, you can look up your Job Code in MySource (My Info —> Compensation —> Salary/Job Summary) and then view the job code list to see which severance group it aligns with.

What if I am employed outside of the U.S. and I am already entitled to severance/termination or similar pay that is less than the CIC Severance amount?

If there is a Change in Control along with a qualifying termination, and your existing severance/termination or similar pay entitlement is below the cash severance amount outlined in the CIC Severance Plan, then you will receive an amount through the CIC Severance Plan to bring you up to the amount of cash severance for your job level in the CIC Severance Plan.

What happens to my Qualcomm stock awards in the event of a Change in Control?

If an employee were affected by a qualifying termination during the two-year period following a Change in Control, all unvested stock awards would vest upon termination. Detailed information can be found in your stock plan agreement, which is available in your E*TRADE account with your grant notice. It can also be found on the go/stock site under Plan Documents.

Does this new Change in Control Severance Plan signify that the Broadcom acquisition is likely to happen?

This filing is not intended to signal any new developments regarding Broadcom’s proposal to acquire Qualcomm or their Board nominations. It is an action taken by our Board of Directors to support and retain our employees by providing financial protection if Qualcomm undergoes a Change in Control.

Will Broadcom honor this plan if they acquire Qualcomm?

To provide security for employees, the plan cannot be changed for at least two years following a Change in Control and Broadcom’s failure to honor its obligations is a severance-qualifying event under the Plan.

Additional Information

Qualcomm has filed a preliminary proxy statement and WHITE proxy card with the U.S. Securities and Exchange Commission (the “SEC”) in connection with its solicitation of proxies for its 2018 Annual Meeting of Stockholders (the “2018 Annual Meeting”). QUALCOMM STOCKHOLDERS ARE STRONGLY ENCOURAGED TO READ THE DEFINITIVE PROXY STATEMENT (AND ANY AMENDMENTS AND SUPPLEMENTS THERETO) AND ACCOMPANYING WHITE PROXY CARD WHEN THEY BECOME AVAILABLE AS THEY WILL CONTAIN IMPORTANT INFORMATION. Stockholders may obtain the proxy statement, any amendments or supplements to the proxy statement and other documents as and when filed by Qualcomm with the SEC without charge from the SEC’s website at www.sec.gov.

Certain Information Regarding Participants

Qualcomm, its directors and certain of its executive officers may be deemed to be participants in connection with the solicitation of proxies from Qualcomm’s stockholders in connection with the matters to be considered at the 2018 Annual Meeting. Information regarding the identity of potential participants, and their direct or indirect interests, by security holdings or otherwise, is set forth in the proxy statement and other materials to be filed with the SEC. These documents can be obtained free of charge from the sources indicated above.

Cautionary Note Regarding Forward-Looking Statements

Any statements contained in this communication that are not historical facts are forward-looking statements as defined in the U.S. Private Securities Litigation Reform Act of 1995. Words such as “anticipate,” “believe,” “estimate,” “expect,” “forecast,” “intend,” “may,” “plan,” “project,” “predict,” “should,” “will” and similar expressions are intended to identify such forward-looking statements. These statements are based on Qualcomm’s current expectations or beliefs, and are subject to uncertainty and changes in circumstances. Actual results may differ materially from those expressed or implied by the statements herein due to changes in economic, business, competitive, technological, strategic and/or regulatory factors, and other factors affecting the operations of Qualcomm. More detailed information about these factors may be found in Qualcomm’s filings with the SEC, including those discussed in Qualcomm’s most recent Annual Report on Form 10-K and in any subsequent periodic reports on Form 10-Q and Form 8-K, each of which is on file with the SEC and available at the SEC’s website at www.sec.gov. SEC filings for Qualcomm are also available in the Investor Relations section of Qualcomm’s website at www.qualcomm.com. Qualcomm is not obligated to update these forward-looking statements to reflect events or circumstances after the date of this communication. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of their dates.