QUALCOMM Incorporated

Conflict Minerals Report

Reporting Period: January 1, 2022 – December 31, 2022

We are a global leader in the development and commercialization of foundational technologies for the wireless industry, including 3G (third generation), 4G (fourth generation) and 5G (fifth generation) wireless technologies and processor technologies including high-performance, low-power computing and on-device artificial intelligence (AI) technologies. Our technologies and products are used in mobile devices and other wireless products. Our inventions have helped power the growth in smartphones and other cellular enabled devices. As a connected processor company, we are scaling our innovations using our one technology roadmap to enable the connected intelligent edge (the next generation of smart devices) across industries and applications beyond handsets, including automotive and the internet of things (IoT). In IoT, our inventions have helped power growth in industries and applications such as consumer (including computing, voice and music and XR), edge networking (including mobile broadband and wireless access points) and industrial (including handhelds, retail, transportation and logistics and utilities). In automotive, our connectivity, digital cockpit, and advanced driver assistance (ADAS) and automated driving (AD) platforms (collectively, ADAS/AD) are helping to connect the car to its environment and the cloud, create unique in-cabin experiences and enable a comprehensive assisted and automated driving solution. We derive revenues principally from sales of integrated circuit products, including our Snapdragon® family of highly-integrated, system-based solutions, and licensing of our intellectual property, including patents and other rights.

Qualcomm Incorporated includes our licensing business and the vast majority of our patent portfolio. Qualcomm Technologies, Inc., a subsidiary of Qualcomm Incorporated, operates, along with its subsidiaries, substantially all of our engineering and research and development functions and substantially all of our products and services businesses, including our integrated circuit business. In this document, the words “we,” “our” and “us” refer only to Qualcomm Incorporated, Qualcomm Technologies, Inc. and/or their subsidiaries.

This Conflict Minerals Report (this Report) contains forward-looking statements regarding our business, products and our efforts to mitigate the risk that conflict minerals (as defined below) in our products directly or indirectly finance or benefit armed groups (identified as a perpetrator of serious human rights abuses) in the Democratic Republic of the Congo (the DRC) or an adjoining country (a country that shares an internationally recognized border with the DRC). The DRC and adjoining countries are collectively referred to as the “Covered Countries.” The Covered Countries include Angola, Burundi, Central Africa Republic, Congo, Democratic Republic of the Congo, Rwanda, South Sudan, Tanzania, Uganda and Zambia. Words such as “expects,” “intends,” “believes,” “strives” and similar expressions or variations of such words are intended to identify forward-looking statements, but are not the exclusive means of identifying forward-looking statements in this Report. Additionally, statements concerning future matters that are not historical are forward-looking statements.

Although forward-looking statements in this Report reflect our good faith judgment, such statements can only be based on facts and factors currently known by us. Consequently, forward-looking statements are inherently subject to risks and uncertainties, and actual results and outcomes may differ materially from the results and outcomes discussed in or anticipated by the forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include without limitation: the risk that information reported to us by our suppliers from which we directly procure finished goods, components, materials and/or services for our products (direct suppliers), or industry information used by us, may be inaccurate or incomplete; and the risk that smelters or refiners (processing facilities) may not participate in the Responsible Minerals Assurance Process (RMAP), which is a voluntary initiative in which independent third parties audit processing facilities’ procurement and processing activities and determine if the processing facilities maintain sufficient documentation to reasonably demonstrate conflict free sourcing; as well as risks discussed under the heading “Risk Factors” in our most recent Quarterly

Report on Form 10-Q, including those related to our dependence on a limited number of third-party suppliers, the operation and control of our manufacturing facilities, and our being subject to government regulations and policies. Readers are urged not to place undue reliance on forward-looking statements, which speak only as of the date of this Report. We undertake no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this Report. Throughout this Report, whenever a reference is made to our website, such reference does not incorporate information from the website by reference into this Report unless specifically identified as such.

Background

Pursuant to the Dodd-Frank Wall Street Reform and Consumer Protection Act, the United States Securities and Exchange Commission (SEC) promulgated a rule (the Final Rule) requiring certain companies with conflict minerals (columbite-tantalite (coltan), cassiterite, gold, wolframite or their derivatives, which are limited to tantalum, tin and tungsten) that are necessary to the functionality or production of a product manufactured by or for that company to, among other things, disclose annually whether any of those conflict minerals originated in the Covered Countries; and if so, to submit a report to the SEC that includes a description of the measures it took to exercise due diligence on the conflict minerals’ source and chain of custody.

The Responsible Business Alliance (RBA) and the Global e-Sustainability Initiative (GeSI) established an initiative that is known as the Responsible Minerals Initiative (RMI). The RMI, which is comprised of over 400 companies from multiple industries, together with the RBA and GeSI, strive to provide companies with tools and resources to make sourcing decisions that improve regulatory compliance and support responsible sourcing from conflict-affected and high-risk areas.

We are a full member of the RBA, have adopted the RBA Code of Conduct and expect all of our direct suppliers to act in accordance with this Code of Conduct. By employing RBA tools and working collaboratively with our peers, we are working to improve transparency and sustainability in the global electronics supply chain. We actively participate in and support responsible sourcing initiatives of the RMI.

We, along with many other companies, rely on the RMI’s RMAP to verify processing facilities as not directly or indirectly financing or benefiting armed groups in the Covered Countries (RMAP-Conformant). The RMI also recognizes responsible sourcing practices of processing facilities that have been accredited by the London Bullion Market Association (LBMA) or certified by the Responsible Jewellery Council (RJC).

Summary

In accordance with the Final Rule, we conducted in good faith a reasonable country of origin inquiry (RCOI) that was reasonably designed to determine whether any of the necessary conflict minerals in our products originated in the Covered Countries or were from recycled or scrap sources.

Based on our RCOI, we believe that some of the necessary conflict minerals used in our products originated in one or more of the Covered Countries (and are not from recycled or scrap sources). Accordingly, we exercised due diligence to determine the source and chain of custody of these conflict minerals. Our due diligence was designed to conform to an internationally recognized due diligence framework, specifically the Organisation for Economic Co-operation and Development (OECD) “Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas,” 3rd edition (2016) (OECD Guidance).

Following the exercise of our due diligence (which is inherently subject to and limited by our ability to obtain reliable mine or location of origin information for conflict minerals that are used specifically in our products), we

have not identified any instances in which our sourcing of necessary conflict minerals directly or indirectly financed or benefitted armed groups in the Covered Countries.

Product Description

Our integrated circuit products are sold to manufacturers that use our products in a broad range of devices, from low-tier, entry-level devices primarily for emerging regions to premium-tier devices, including but not limited to mobile devices, wireless networks, devices used in IoT, broadband gateway equipment, consumer electronic devices and automotive systems for connectivity, digital cockpit and advanced driver assistance and automated driving.

The Snapdragon family of highly-integrated, system-based solutions include the Snapdragon mobile, compute, sound and automotive platforms. Each platform consists of application processors and wireless connectivity capabilities, including our cellular modem that provides core baseband modem functionality for voice and data communications, non-cellular wireless connectivity (such as Wi-Fi and Bluetooth) and global positioning functions. Our Snapdragon application processor functions include CPU, security, graphics, display, audio, video, camera and artificial intelligence (AI). Our CPUs are designed to deliver high levels of compute performance with optimized power consumption. Our Qualcomm® Hexagon™ processors are designed to support a variety of signal processing applications, including AI, audio and sensor processing. Our Qualcomm® Adreno™ graphics processing units are designed to deliver high quality graphics performance for visually rich 3D gaming and user interfaces. In addition to the highly integrated core SoC (system on chip), we also design and supply supporting components, including the RF (radio frequency) transceiver, PM (power management), audio, codecs, speaker amps and additional wireless connectivity integrated circuits. Our portfolio of RF products includes Qualcomm® radio frequency front-end (RFFE) components that are designed to simplify the RF design for 5G front-end, LTE multimode and multiband mobile devices, including sub-6 GHz and millimeter wave devices, to reduce power consumption and to improve radio performance.

Our wireless connectivity products also consist of integrated circuits and system software products for Wi-Fi, Bluetooth and frequency modulation, as well as technologies that support location data and services, including GPS, GLONASS, Galileo, NavIC and BeiDou. Our wireless connectivity products provide additional connectivity for mobile devices, tablets, laptops, XR headsets, voice and music devices, wearable devices, along with other IoT devices and applications, automotive connectivity, digital cockpit, ADAS/AD, utility meters and logistic trackers and industrial sensors.

Description of Supply Chain

During the reporting period, other than for certain of our RFFE modules and RF filter products, we utilized a fabless production model in the manufacturing of our integrated circuits, which means that we did not own or operate foundries for the production of silicon wafers from which our integrated circuits were made. Therefore, we primarily rely on third parties to perform the manufacturing and assembly, and most of the testing, of our integrated circuits based primarily on our proprietary designs and test programs. Our suppliers also are responsible for the procurement of most of the raw materials used in the production of our integrated circuits. Integrated circuits are die cut from silicon wafers that have completed the package assembly and test manufacturing processes. The semiconductor package supports the electrical contacts that connect the integrated circuit to a circuit board. Die cut from silicon wafers are the essential components of all of our integrated circuits and a significant portion of the total integrated circuit cost. We employ both turnkey and two-stage manufacturing models to purchase our integrated circuits. Under the turnkey model, our foundry suppliers are responsible for delivering fully assembled and tested integrated circuits. Under the two-stage manufacturing model, we purchase die in singular or wafer form from semiconductor

manufacturing foundries and contract with separate third parties for manufacturing services such as wafer bump, probe, assembly and the majority of our final test requirements.

We primarily used internal fabrication facilities to manufacture certain RFFE modules and RF filter products, and our manufacturing operations consist of front-end and back-end processes. The front-end processes primarily take place at our manufacturing facilities located in Germany and Singapore and involve the imprinting of substrate wafers with the structure and circuitry required for the products to function (also known as wafer fabrication). The back-end processes include the assembly, packaging and test of RFFE modules and RF filter products and their preparation for distribution. Our back-end manufacturing facilities are located in China and Singapore.

Certain materials purchased by our direct suppliers may come directly or indirectly from processing facilities that treat ores, concentrates, slags or secondary materials. Because we do not purchase any materials directly from these processing facilities, we must rely on the information provided by our direct suppliers and the RMI or other industry organizations in order to prepare this Report.

Policy on Responsible Sourcing of Minerals

Our policy on responsible sourcing of minerals communicates the expectation that our direct suppliers obtain materials from environmentally and socially responsible sources, including conflict free sources within the Covered Countries (available at: www.qualcomm.com/conflict-free-minerals).

Reasonable Country of Origin Inquiry

To conduct our RCOI and obtain sourcing information from our direct suppliers, we used the RMI Conflict Minerals Reporting Template (CMRT). We requested this information from 100% of our direct suppliers that may provide necessary conflict minerals in our products to determine whether any of these materials originated in the Covered Countries. We received CMRT responses from 100% of the direct suppliers of our products.

Our RCOI considered the countries of origin information obtained from our direct suppliers as well as RMAP-Conformant processing facilities’ country of origin data available to RMI members. Based on these sources of country of origin information, approximately 7% (17) of the processing facilities reported by our direct suppliers were confirmed as sourcing conflict minerals from the Covered Countries.

Design of Due Diligence

Our due diligence measures have been designed to conform, in all material respects, to the framework provided by the OECD Guidance.

OECD Step 1: Establish Strong Company Management Systems

•We publicly communicate our policy on responsible sourcing of materials on our website.

•We maintain a conflict minerals working group with representation from our finance, government affairs, internal audit, legal, regulatory, quality and supply chain departments, which report on compliance activities to executive management and the Audit Committee of our Board of Directors.

•We include conflict free minerals requirements in purchasing documents to direct suppliers.

•We maintain a public contact form on our website for general inquiries and grievances regarding our conflict minerals program (available at: www.qualcomm.com/cm-contact).

OECD Step 2: Identify and Assess Risk in the Supply Chain

•We use the CMRT to review our direct suppliers’ due diligence activities, such as whether they have a conflict minerals policy, require their own suppliers to source from RMAP-Conformant processing facilities and have a review process that includes corrective action management.

•We use the CMRT to identify conflict minerals processing facilities when reported in our supply chain by our direct suppliers.

•We obtain countries of origin information (when available) for RMAP-Conformant processing facilities by relying on data provided by our direct suppliers and the RMI.

•We conduct periodic on-site and remote assessments of select direct suppliers’ due diligence activities to validate CMRT responses and ensure our supplier requirements are being met.

OECD Step 3: Design and Implement a Strategy to Respond to Risk

•We maintain a conflict minerals risk management plan that sets forth direct supplier risk management strategies ranging from continued procurement to disengagement at the discretion of management.

•We support the development of due diligence practices through participation in RMI working groups.

•We report information on the source and chain of custody of conflict minerals in our supply chain to our conflict minerals working group, executive management and the Audit Committee of our Board of Directors.

OECD Step 4: Third-Party Audit of Processing Facilities’ Due Diligence Practices

•We use the publicly available results of the RMAP, LBMA and RJC third-party audits to validate the responsible sourcing practices of processing facilities in our supply chain.

•We support independent third-party audits of processing facilities through our RMI membership.

OECD Step 5: Report Annually on Supply Chain Due Diligence

•We file a Specialized Disclosure Report on Form SD and Conflict Minerals Report with the SEC on an annual basis. Our Form SD and Conflict Minerals Report are also available on our website.

•We provide information regarding our conflict minerals program on our website.

Description of Due Diligence Performed

Below is a description of the measures we performed for this reporting period to exercise due diligence on the source and chain of custody of the necessary conflict minerals in our products that may have originated in the Covered Countries.

•We conducted our supply chain survey on 100% of our direct suppliers that may use necessary conflict minerals in our products to determine whether any of these minerals originated in the Covered Countries or were from recycled or scrap sources.

•We determined if the processing facilities reported to us by our direct suppliers adhere to responsible sourcing practices by verifying whether they are RMAP-Conformant.

•We communicated and addressed, with our direct suppliers, instances identified in the CMRT in which our requirements were not met or quality issues were apparent. This communication reinforced our requirements to support the sourcing of materials from conflict free sources within the Covered Countries.

•We conducted a conflict minerals verification assessment of due diligence activities at four integrated circuit direct supplier sites.

•We were members of non-profit and industry initiatives, including the RMI and the International Tin Research Institute Supply Chain Initiative (iTSCi) Programme.

•We reported on program activities to members of executive management and the Audit Committee of our Board of Directors.

Facilities Used to Process the Necessary Conflict Minerals in Our Products

We rely on the good faith efforts of our direct suppliers to provide us with reasonable representations of the processing facilities used to supply the necessary conflict minerals in our products. In the reporting period, 38% of our direct supplier responses represented their supply chain at a company level, 42% at a product level and 20% at a supplier-defined level (e.g., at a divisional or subsidiary level). As such, the list of processing facilities disclosed at the end of this Report may over-represent the number of processing facilities that process the conflict minerals actually contained in our products.

All processing facilities listed in this Report are reported by RMAP status in Table 1 in the section “Table of Conflict Minerals Processing Facilities” at the end of this Report.

Country of Origin of the Necessary Conflict Minerals in Our Products

Based on country of origin information provided by the RMI for RMAP-Conformant processing facilities, countries of origin of the necessary conflict minerals in our products may include: Andorra, Angola, Antigua and Barbuda, Argentina, Armenia, Australia, Austria, Azerbaijan, Bahamas, Bahrain, Bangladesh, Barbados, Belarus, Belgium, Benin, Bolivia, Botswana, Brazil, Bulgaria, Burkina Faso, Burundi, Canada, Cayman Islands, Chile, China, Colombia, Côte d'Ivoire, Croatia, Curacao, Czech Republic, Democratic Republic of the Congo, Denmark, Dominican Republic, Ecuador, Egypt, El Salvador, Eritrea, Estonia, Ethiopia, Fiji, Finland, France, French Guiana, Germany, Ghana, Greece, Grenada, Guatemala, Guinea, Guyana, Honduras, Hong Kong, Hungary, India, Indonesia, Ireland, Israel, Italy, Japan, Jordan, Kazakhstan, Kenya, Kuwait, Kyrgyzstan, Laos, Latvia, Lebanon, Liberia, Lithuania, Luxembourg, Malaysia, Mali, Malta, Mauritania, Mexico, Mongolia, Morocco, Mozambique, Myanmar, Namibia, Netherlands, New Zealand, Nicaragua, Niger, Nigeria, Norway, Oman, Pakistan, Panama, Papua New Guinea, Peru, Philippines, Poland, Portugal, Puerto Rico, Republic of Korea, Romania, Russian Federation, Rwanda, Saint Kitts and Nevis, Saint Vincent and Grenadines, Saudi Arabia, Senegal, Serbia, Sierra Leone, Singapore, Sint Maarten, Slovakia, Slovenia, South Africa, Spain, Sudan, Suriname, Swaziland, Sweden, Switzerland, Taiwan, Tanzania, Thailand, Togo, Trinidad and Tobago, Tunisia, Turkey, Turks and Caicos, Uganda, Ukraine, United Arab Emirates, United Kingdom of Great Britain and Northern Ireland, United States of America, Uruguay, Uzbekistan, Venezuela, Vietnam, Yemen, Zambia, and Zimbabwe.

Our Efforts to Determine the Mine or Location of Origin of the Necessary Conflict Minerals in Our Products

We requested location of mine and location of origin information for the necessary conflict minerals contained in our products from each of our direct suppliers using the CMRT. In some instances, our direct suppliers reported the name or location of the mine. However, many of our direct suppliers were unable to obtain reliable mine or location of origin data for the necessary conflict minerals used in our products.

Steps We Have Taken to Mitigate the Risk that the Necessary Conflict Minerals in Our Products Benefit Armed Groups

We have worked with our direct suppliers on responsible sourcing and have actively participated in responsible sourcing initiatives of the RMI, as we continue to strive towards our goal of having the processing facilities that may supply conflict minerals contained in our products be 100% RMAP-Conformant. Additional information regarding the steps we have taken to mitigate the risk that conflict minerals that may be contained in our products benefit armed groups in the Covered Countries can be found under the sections “Design of Due Diligence” and “Description of Due Diligence Performed” above.

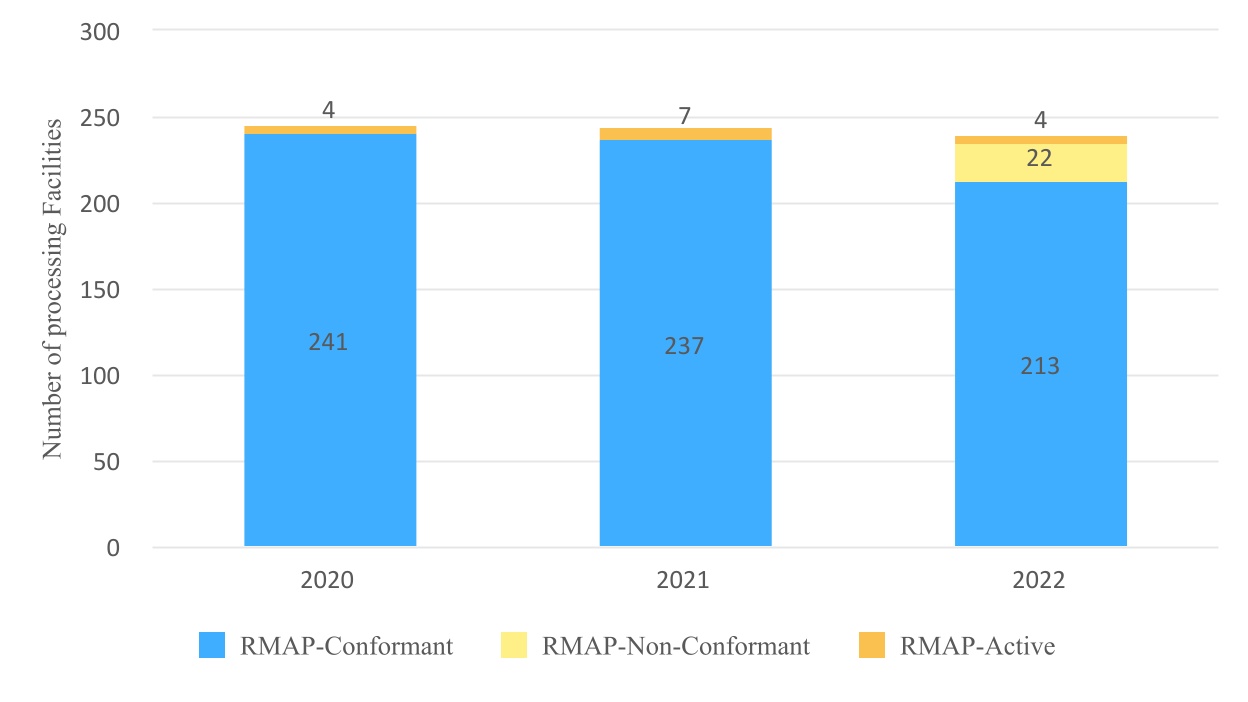

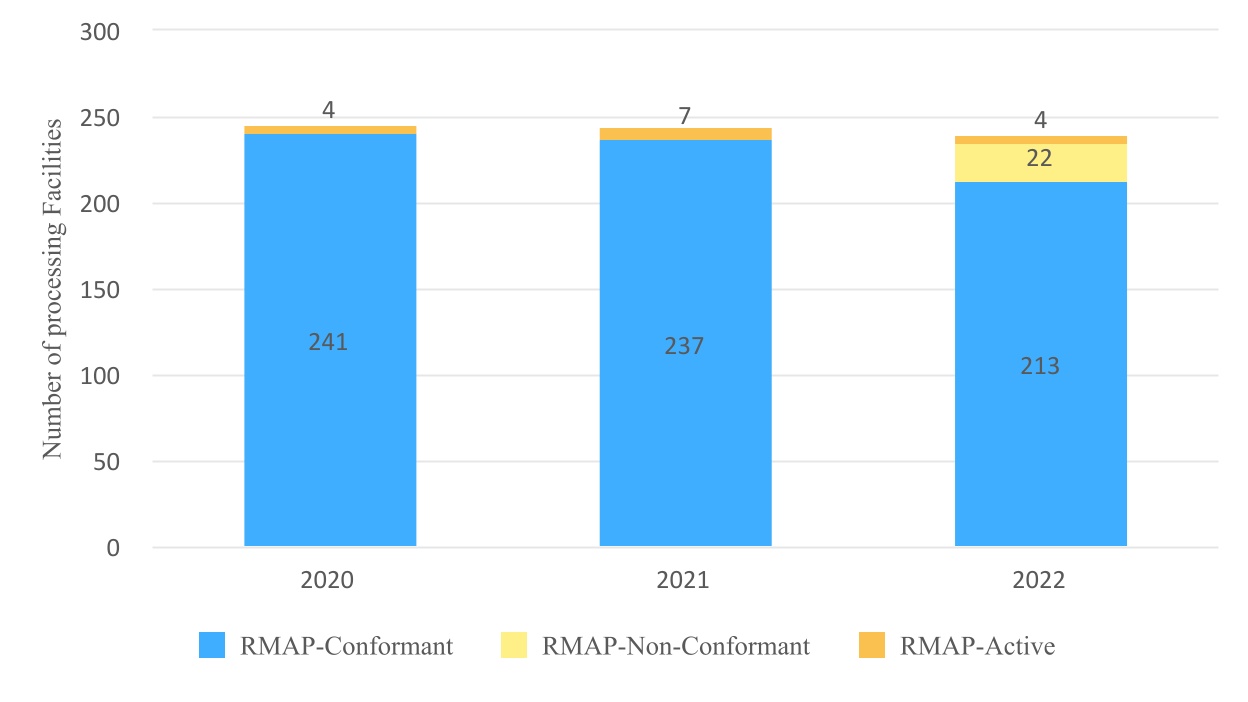

Figure 1 displays the RMAP status of processing facilities for our products in our supply chain from reporting years 2020 through 2022.

Figure 1: 2020-2022 Processing Facilities by RMAP Status

Note: RMAP-Conformant processing facilities are audited and found conformant with the relevant RMAP standard and include processing facilities currently undergoing a re-audit or processing facilities certified by the LBMA or RJC. RMAP-Active processing facilities have committed to undergo an RMAP audit but are not yet conformant. RMAP-Non-Conformant processing facilities meet or have met the definition of a smelter or refiner but have been found non-conformant or are unable to be assessed with the relevant RMAP standard.

Note: The increase in RMAP-Non-Conformant processing facilities in 2022 is largely due to (i) certain processing facilities being located in the Russian Federation, where RMI due diligence could not be conducted, and (ii) certain processing facilities withdrawing from RMAP due to resource constraints, the cost of audit and complexity of requirements. The majority of the facilities reported as RMAP-Non-Conformant for 2022 were reported by our direct suppliers as RMAP-Conformant for 2021.

Steps We Will Take to Mitigate the Risk that the Necessary Conflict Minerals in Our Products Benefit Armed Groups

During reporting year 2023, we intend to conduct the following due diligence activities to continue to mitigate the risk that the necessary conflict minerals in our products directly or indirectly finance or benefit armed groups in the Covered Countries:

1.Engage with direct suppliers, processing facilities and the RMI to encourage Non-Participating processing facilities to become RMAP-Conformant;

2.Strive to use only direct suppliers that source from RMAP-Conformant processing facilities for our products;

3.Conduct on-site verification assessments of certain suppliers’ due diligence activities;

4.Conduct due diligence on new businesses acquired to assess the risk of conflict minerals in the acquired businesses’ supply chain; and

5.Participate in the following industry coalitions’ and non-governmental organizations’ efforts to support the responsible sourcing of minerals: RBA, RMI and the International Tin Association.

Table of Conflict Minerals Processing Facilities

The processing facilities listed in Table 1 are processing facilities reported by our direct suppliers during the reporting period.

Table 1. Processing Facilities as of January 31, 2023

| | | | | | | | | |

| Metal | Processing Facility Name | Processing Facility Country | |

| Gold | Metal Concentrators SA (Pty) Ltd. | SOUTH AFRICA | |

| Gold | Eco-System Recycling Co., Ltd. West Plant | JAPAN | |

| Gold | Eco-System Recycling Co., Ltd. North Plant | JAPAN | |

| Gold | NH Recytech Company | KOREA, REPUBLIC OF | |

| Gold | Safimet S.p.A* | ITALY | |

| Gold | Planta Recuperadora de Metales SpA | CHILE | |

| Gold | SungEel HiMetal Co., Ltd. | KOREA, REPUBLIC OF | |

| Gold | Bangalore Refinery | INDIA | |

| Gold | Ogussa Osterreichische Gold- und Silber-Scheideanstalt GmbH | AUSTRIA | |

| Gold | WIELAND Edelmetalle GmbH | GERMANY | |

| Gold | Italpreziosi | ITALY | |

| Gold | 8853 S.p.A.* | ITALY | |

| Gold | L'Orfebre S.A. | ANDORRA | |

| Gold | SAAMP | FRANCE | |

| Gold | TOO Tau-Ken-Altyn | KAZAKHSTAN | |

| Gold | Korea Zinc Co., Ltd. | KOREA, REPUBLIC OF | |

| Gold | Remondis PMR B.V. | NETHERLANDS | |

| Gold | T.C.A S.p.A | ITALY | |

| Gold | Emirates Gold DMCC | UNITED ARAB EMIRATES | |

| Gold | Al Etihad Gold Refinery DMCC | UNITED ARAB EMIRATES | |

| Gold | Singway Technology Co., Ltd.* | TAIWAN | |

| | | | | | | | | |

| Gold | KGHM Polska Miedz Spolka Akcyjna | POLAND | |

| Gold | MMTC-PAMP India Pvt., Ltd. | INDIA | |

| Gold | Geib Refining Corporation | UNITED STATES | |

| Gold | Umicore Precious Metals Thailand | THAILAND | |

| Gold | SAFINA A.S. | CZECH REPUBLIC | |

| Gold | Gold Refinery of Zijin Mining Group Co., Ltd. | CHINA | |

| Gold | Zhongyuan Gold Smelter of Zhongjin Gold Corporation | CHINA | |

| Gold | Yokohama Metal Co., Ltd. | JAPAN | |

| Gold | Yamakin Co., Ltd. | JAPAN | |

| Gold | Western Australia Mint (T/a The Perth Mint) | AUSTRALIA | |

| Gold | Valcambi S.A. | SWITZERLAND | |

| Gold | United Precious Metal Refining, Inc. | UNITED STATES | |

| Gold | Umicore S.A. Business Unit Precious Metals Refining | BELGIUM | |

| Gold | Torecom | KOREA, REPUBLIC OF | |

| Gold | Tokuriki Honten Co., Ltd. | JAPAN | |

| Gold | Shandong Gold Smelting Co., Ltd. | CHINA | |

| Gold | Tanaka Kikinzoku Kogyo K.K. | JAPAN | |

| Gold | Sumitomo Metal Mining Co., Ltd. | JAPAN | |

| Gold | Solar Applied Materials Technology Corp. | TAIWAN | |

| Gold | Sichuan Tianze Precious Metals Co., Ltd. | CHINA | |

| Gold | Shandong Zhaojin Gold & Silver Refinery Co., Ltd. | CHINA | |

| Gold | SEMPSA Joyeria Plateria S.A. | SPAIN | |

| Gold | Samduck Precious Metals | KOREA, REPUBLIC OF | |

| Gold | Royal Canadian Mint | CANADA | |

| Gold | Rand Refinery (Pty) Ltd. | SOUTH AFRICA | |

| Gold | PX Precinox S.A. | SWITZERLAND | |

| Gold | PT Aneka Tambang (Persero) Tbk | INDONESIA | |

| Gold | MKS PAMP SA | SWITZERLAND | |

| Gold | Ohura Precious Metal Industry Co., Ltd. | JAPAN | |

| Gold | Nihon Material Co., Ltd. | JAPAN | |

| Gold | Navoi Mining and Metallurgical Combinat | UZBEKISTAN | |

| Gold | Nadir Metal Rafineri San. Ve Tic. A.S. | TURKEY | |

| Gold | Mitsui Kinzoku Co., Ltd. | JAPAN | |

| Gold | Mitsubishi Materials Corporation | JAPAN | |

| Gold | Metalurgica Met-Mex Penoles S.A. de C.V | MEXICO | |

| Gold | Metalor USA Refining Corporation | UNITED STATES | |

| Gold | Metalor Technologies S.A. | SWITZERLAND | |

| Gold | Metalor Technologies (Singapore) Pte., Ltd. | SINGAPORE | |

| Gold | Metalor Technologies (Hong Kong) Ltd. | CHINA | |

| Gold | Metalor Technologies (Suzhou) Ltd. | CHINA | |

| Gold | Matsuda Sangyo Co., Ltd. | JAPAN | |

| Gold | Materion | UNITED STATES | |

| Gold | LS-NIKKO Copper Inc. | KOREA, REPUBLIC OF | |

| Gold | Kojima Chemicals Co., Ltd | JAPAN | |

| Gold | Kennecott Utah Copper LLC | UNITED STATES | |

| | | | | | | | | |

| Gold | Kazzinc | KAZAKHSTAN | |

| Gold | JX Nippon Mining & Metals Co., Ltd. | JAPAN | |

| Gold | Asahi Refining Canada Ltd. | CANADA | |

| Gold | Asahi Refining USA Ltd. | UNITED STATES | |

| Gold | Jiangxi Copper Co., Ltd. | CHINA | |

| Gold | Japan Mint | JAPAN | |

| Gold | Istanbul Gold Refinery | TURKEY | |

| Gold | Ishifuku Metal Industry Co., Ltd. | JAPAN | |

| Gold | Inner Mongolia Qiankun Gold and Silver Refinery Share Co., Ltd. | CHINA | |

| Gold | Heraeus Germany GmbH & Co. KG | GERMANY | |

| Gold | Heraeus Metals Hong Kong Ltd. | CHINA | |

| Gold | Heimerle + Meule GmbH | GERMANY | |

| Gold | LT Metal Ltd. | KOREA, REPUBLIC OF | |

| Gold | Eco-System Recycling Co., Ltd. East Plant | JAPAN | |

| Gold | Dowa | JAPAN | |

| Gold | DSC (Do Sung Corporation) | KOREA, REPUBLIC OF | |

| Gold | Chugai Mining | JAPAN | |

| Gold | Chimet S.p.A. | ITALY | |

| Gold | Cendres + Metaux S.A.* | SWITZERLAND | |

| Gold | CCR Refinery - Glencore Canada Corporation | CANADA | |

| Gold | C. Hafner GmbH + Co. KG | GERMANY | |

| Gold | Boliden AB | SWEDEN | |

| Gold | Bangko Sentral ng Pilipinas (Central Bank of the Philippines) | PHILIPPINES | |

| Gold | Aurubis AG | GERMANY | |

| Gold | Asaka Riken Co., Ltd. | JAPAN | |

| Gold | Asahi Pretec Corp. | JAPAN | |

| Gold | Argor-Heraeus S.A. | SWITZERLAND | |

| Gold | AngloGold Ashanti Corrego do Sitio Mineracao | BRAZIL | |

| Gold | Almalyk Mining and Metallurgical Complex (AMMC) | UZBEKISTAN | |

| Gold | Agosi AG | GERMANY | |

| Gold | Aida Chemical Industries Co., Ltd. | JAPAN | |

| Gold | Advanced Chemical Company | UNITED STATES | |

| Gold | C.I Metales Procesados Industriales SAS** | COLOMBIA | |

| Gold | Marsam Metals* | BRAZIL | |

| Gold | SOE Shyolkovsky Factory of Secondary Precious Metals* | RUSSIAN FEDERATION | |

| Gold | Prioksky Plant of Non-Ferrous Metals* | RUSSIAN FEDERATION | |

| Gold | OJSC Krastsvetmet* | RUSSIAN FEDERATION | |

| Gold | Moscow Special Alloys Processing Plant* | RUSSIAN FEDERATION | |

| Gold | JSC Uralelectromed* | RUSSIAN FEDERATION | |

| Gold | JSC Novosibirsk Refinery* | RUSSIAN FEDERATION | |

| Tantalum | RFH Yancheng Jinye New Material Technology Co., Ltd. | CHINA | |

| Tantalum | Jiangxi Tuohong New Raw Material | CHINA | |

| Tantalum | Resind Industria e Comercio Ltda. | BRAZIL | |

| Tantalum | Global Advanced Metals Aizu | JAPAN | |

| Tantalum | Global Advanced Metals Boyertown | UNITED STATES | |

| | | | | | | | | |

| Tantalum | H.C. Starck Smelting GmbH & Co. KG | GERMANY | |

| Tantalum | Taniobis Japan Co., Ltd. | JAPAN | |

| Tantalum | Materion Newton Inc. | UNITED STATES | |

| Tantalum | QSIL Metals Hermsdorf GmbH | GERMANY | |

| Tantalum | Taniobis GmbH | GERMANY | |

| Tantalum | Taniobis Co., Ltd. | THAILAND | |

| Tantalum | KEMET de Mexico | MEXICO | |

| Tantalum | Jiangxi Dinghai Tantalum & Niobium Co., Ltd. | CHINA | |

| Tantalum | XinXing HaoRong Electronic Material Co., Ltd. | CHINA | |

| Tantalum | Jiujiang Zhongao Tantalum & Niobium Co., Ltd. | CHINA | |

| Tantalum | FIR Metals & Resource Ltd. | CHINA | |

| Tantalum | D Block Metals, LLC | UNITED STATES | |

| Tantalum | Hengyang King Xing Lifeng New Materials Co., Ltd. | CHINA | |

| Tantalum | Ulba Metallurgical Plant JSC | KAZAKHSTAN | |

| Tantalum | Telex Metals | UNITED STATES | |

| Tantalum | Taki Chemical Co., Ltd. | JAPAN | |

| Tantalum | Yanling Jincheng Tantalum & Niobium Co., Ltd. | CHINA | |

| Tantalum | QuantumClean | UNITED STATES | |

| Tantalum | Ningxia Orient Tantalum Industry Co., Ltd. | CHINA | |

| Tantalum | NPM Silmet AS | ESTONIA | |

| Tantalum | Mitsui Mining and Smelting Co., Ltd. | JAPAN | |

| Tantalum | Mineracao Taboca S.A. | BRAZIL | |

| Tantalum | Metallurgical Products India Pvt., Ltd. | INDIA | |

| Tantalum | AMG Brasil | BRAZIL | |

| Tantalum | Jiujiang Tanbre Co., Ltd. | CHINA | |

| Tantalum | JiuJiang JinXin Nonferrous Metals Co., Ltd. | CHINA | |

| Tantalum | Ximei Resources (Guangdong) Limited | CHINA | |

| Tantalum | F&X Electro-Materials Ltd. | CHINA | |

| Tantalum | Changsha South Tantalum Niobium Co., Ltd. | CHINA | |

| Tantalum | Solikamsk Magnesium Works OAO* | RUSSIAN FEDERATION | |

| Tin | PT Putera Sarana Shakti (PT PSS) | INDONESIA | |

| Tin | Fabrica Auricchio Industria e Comercio Ltda. | BRAZIL | |

| Tin | CRM Synergies | SPAIN | |

| Tin | PT Mitra Sukses Globalindo | INDONESIA | |

| Tin | Luna Smelter, Ltd. | RWANDA | |

| Tin | PT Rajawali Rimba Perkasa | INDONESIA | |

| Tin | Tin Technology & Refining | UNITED STATES | |

| Tin | PT Bangka Serumpun | INDONESIA | |

| Tin | Chifeng Dajingzi Tin Industry Co., Ltd. | CHINA | |

| Tin | Guangdong Hanhe Non-Ferrous Metal Co., Ltd. | CHINA | |

| Tin | PT Menara Cipta Mulia | INDONESIA | |

| Tin | PT Sukses Inti Makmur | INDONESIA | |

| Tin | Aurubis Berango | SPAIN | |

| Tin | Aurubis Beerse | BELGIUM | |

| Tin | Resind Industria e Comercio Ltda. | BRAZIL | |

| | | | | | | | | |

| Tin | O.M. Manufacturing Philippines, Inc. | PHILIPPINES | |

| Tin | PT ATD Makmur Mandiri Jaya | INDONESIA | |

| Tin | Magnu's Minerais Metais e Ligas Ltda. | BRAZIL | |

| Tin | CV Venus Inti Perkasa** | INDONESIA | |

| Tin | Tin Smelting Branch of Yunnan Tin Co., Ltd | CHINA | |

| Tin | Yunnan Chengfeng Non-ferrous Metals Co., Ltd. | CHINA | |

| Tin | White Solder Metalurgica e Mineracao Ltda. | BRAZIL | |

| Tin | Gejiu Yunxin Nonferrous Electrolysis Co., Ltd.* | CHINA | |

| Tin | Thaisarco | THAILAND | |

| Tin | Rui Da Hung | TAIWAN | |

| Tin | PT Tinindo Inter Nusa | INDONESIA | |

| Tin | PT Timah Tbk Mentok | INDONESIA | |

| Tin | PT Timah Tbk Kundur | INDONESIA | |

| Tin | PT Stanindo Inti Perkasa | INDONESIA | |

| Tin | PT Refined Bangka Tin | INDONESIA | |

| Tin | PT Prima Timah Utama | INDONESIA | |

| Tin | PT Mitra Stania Prima | INDONESIA | |

| Tin | PT Bukit Timah | INDONESIA | |

| Tin | PT Babel Surya Alam Lestari | INDONESIA | |

| Tin | PT Artha Cipta Langgeng | INDONESIA | |

| Tin | Operaciones Metalurgics S.A. | BOLIVIA | |

| Tin | O.M. Manufacturing (Thailand) Co., Ltd. | THAILAND | |

| Tin | Jiangxi New Nanshan Technology Ltd. | CHINA | |

| Tin | Mitsubishi Materials Corporation | JAPAN | |

| Tin | Minsur | PERU | |

| Tin | Toboca/ Paranapenema | BRAZIL | |

| Tin | Metallic Resources, Inc. | UNITED STATES | |

| Tin | Malaysia Smelting Corporation (MSC) | MALAYSIA | |

| Tin | China Tin Group Co., Ltd. | CHINA | |

| Tin | Gejiu Zili Mining and Metallurgy Co., Ltd.* | CHINA | |

| Tin | Gejiu Non-Ferrous Metal Processing Co., Ltd. | CHINA | |

| Tin | Fenix Metals | POLAND | |

| Tin | Estanho de Rondonia S.A. | BRAZIL | |

| Tin | EM Vinto | BOLIVIA | |

| Tin | Dowa Metaltech Co., Ltd. | JAPAN | |

| Tin | Alpha | UNITED STATES | |

| Tin | Chenzhou Yunxiang Mining and Metallurgy Co., Ltd. | CHINA | |

| Tin | Yunnan Yunfan Non-ferrous Metals Co., Ltd.* | CHINA | |

| Tin | Super Ligas** | BRAZIL | |

| Tin | Melt Metais e Ligas S.A.* | BRAZIL | |

| Tin | Gejiu Kai Meng Industry and Trade LLC* | CHINA | |

| Tungsten | Fujian Xinlu Tungsten Co., Ltd. | CHINA | |

| Tungsten | Cronimet Brasil Ltda | BRAZIL | |

| Tungsten | Hubei Green Tungsten Co., Ltd. | CHINA | |

| Tungsten | Lianyou Metals Co., Ltd. | TAIWAN | |

| | | | | | | | | |

| Tungsten | Fujian Ganmin RareMetal Co., Ltd. | CHINA | |

| Tungsten | Moliren Ltd.* | RUSSIAN FEDERATION | |

| Tungsten | ACL Metais Eireli* | BRAZIL | |

| Tungsten | Xinfeng Huarui Tungsten & Molybdenum New Material Co., Ltd. | CHINA | |

| Tungsten | Philippine Chuangxin Industrial Co., Inc. | PHILIPPINES | |

| Tungsten | Ganzhou Haichuang Tungsten Co., Ltd. | CHINA | |

| Tungsten | China Molybdenum Tungsten Co., Ltd. | CHINA | |

| Tungsten | Niagara Refining LLC | UNITED STATES | |

| Tungsten | Jiangwu H.C. Starck Tungsten Products Co., Ltd. | CHINA | |

| Tungsten | Nui Phao H.C. Starck Tungsten Chemicals Manufacturing LLC | VIETNAM | |

| Tungsten | H.C. Starck Smelting GmbH & Co. KG | GERMANY | |

| Tungsten | H.C. Starck Tungsten GmbH | GERMANY | |

| Tungsten | Hunan Shizhuyuan Nonferrous Metals Co., Ltd. Chenzhou Tungsten Products Branch | CHINA | |

| Tungsten | Asia Tungsten Products Vietnam Ltd. | VIETNAM | |

| Tungsten | Ganzhou Seadragon W & Mo Co., Ltd. | CHINA | |

| Tungsten | Jiangxi Gan Bei Tungsten Co., Ltd. | CHINA | |

| Tungsten | Xiamen H.C. | CHINA | |

| Tungsten | Malipo Haiyu Tungsten Co., Ltd. | CHINA | |

| Tungsten | Jiangxi Tonggu Non-ferrous Metallurgical & Chemical Co., Ltd. | CHINA | |

| Tungsten | Jiangxi Xinsheng Tungsten Industry Co., Ltd. | CHINA | |

| Tungsten | Jiangxi Yaosheng Tungsten Co., Ltd. | CHINA | |

| Tungsten | Ganzhou Jiangwu Ferrotungsten Co., Ltd. | CHINA | |

| Tungsten | Xiamen Tungsten Co., Ltd. | CHINA | |

| Tungsten | WBH | AUSTRIA | |

| Tungsten | Kennametal Fallon | UNITED STATES | |

| Tungsten | Ganzhou Huaxing Tungsten Products Co., Ltd. | CHINA | |

| Tungsten | Japan New Metals Co., Ltd. | JAPAN | |

| Tungsten | Hunan Jintai New Material Co., Ltd. | CHINA | |

| Tungsten | Hunan Chenzhou Mining Co., Ltd. | CHINA | |

| Tungsten | Global Tungsten & Powders Corp. | UNITED STATES | |

| Tungsten | Chongyi Zhangyuan Tungsten Co., Ltd. | CHINA | |

| Tungsten | Guangdong Xianglu Tungsten Co., Ltd. | CHINA | |

| Tungsten | Kennametal Huntsville | UNITED STATES | |

| Tungsten | A.L.M.T. Corp. | JAPAN | |

| Tungsten | Albasteel Industria e Comercio de Ligas Para Fundicao Ltd.** | BRAZIL | |

| Tungsten | JSC "Kirovgrad Hard Alloys Plant"* | RUSSIAN FEDERATION | |

| Tungsten | Unecha Refractory metals plant* | RUSSIAN FEDERATION | |

| Tungsten | Hydrometallurg, JSC* | RUSSIAN FEDERATION | |

*Denotes processing facilities that are RMAP-Non-Conformant

**Denotes processing facilities that are RMAP-Active